Small Israeli businesses are struggling, and not always making it. When just a few people from a small business get called up to reserves and are gone for months, it can spell the end of a business. Koret Israel Economic Development Fund (KIEDF) was established in 1994 with the aim of promoting employment and economic mobility, through access to credit, guidance and support for small and micro businesses in Israel's geographic and social periphery. In today’s podcast, which we’ll make available to everyone, we’ll hear how KIEDF is working to address and new and pressing need.

Adi Azaria, CEO: Adi brings over eight years of experience in impact investing and financial management with a proven track record in leading, developing and executing complex projects with cross-sectoral partnerships. Prior to joining KIEDF, Adi served as CFO of Tevet, part of JDC, the largest Jewish humanitarian organization in the world. In addition to her role as CFO, Adi was the founder and manager of JDC's Impact Investment division, where she developed and managed strategic projects worth over NIS 15 million from idea to execution. Adi previously worked at Social Finance Israel, a member of the Social Finance Global Network, the world's leading group of socio-financial intermediaries. Adi was the first woman in Israel to launch a connection to social influence and designed financial mechanisms to solve social problems. She has extensive experience in cultivating and managing relationships with investors and senior stakeholders, as well as raising significant funds. Adi holds a CPA license and holds a double B.A. in Accounting and Economics from Tel Aviv University.

Adir Waldman, Board Chairman: Adir Waldman is the Managing Director of the Freshfields Israel Focus Group, where he leads the international law firm's Israel-related business. He lives in Tel Aviv with his wife and four children. Adir has been involved in a number of social and nonprofit organizations, including KIEDF where he has served as Chairman since 2021. Adir has a B.A. in Political Science and International Studies from Yale College (1997) and a J.D. from Yale Law School (2002). He served as a Corporal in the IDF Nachal Brigade combat unit.

Chagit Rubenstein, Vice President of Operations, Director of Non-Banking: Chagit is Deputy CEO of the Koret Funds Association and manages the non-bank credit and micro-business development programs of the association. For the past 20 years, Chagit has been engaged in initiating, developing and managing programs for the development of small and micro businesses. She holds and BBA from Instead in France and worked for 10 years as a marketing manager in Israeli export companies. In 2000, she won the Hubert Humphrey Fullbright Scholarship for microfinance studies in Washington, DC, and since has been the main developer of the field in Israel, adapting models from around the world to the local reality.

We’re are making this podcast available to everyone. The link at the top of this posting will take you to the full recording of our conversation; below you will find a transcript for those who prefer to read.

We all know that the present war in which Israel is embroiled, the war that may in fact be very far from being over and is soon to become Israel's longest war, is a war that has taken a tremendous toll on Israelis in numerous ways. There are obviously those people whose lives were lost on October 7th, and their families and loved ones who are still coping with enormous grief. There are soldiers who have fallen since then, hundreds of them, tragically, and their families, thousands of wounded soldiers in Israeli hospitals, and all sorts of trauma all across Israeli society.

But it's also equally not surprising that part of the impact of this war has been economic, with so many soldiers away from not only their families, but their businesses for months on end, and with so much property damage, both in the north and in the south, to farms, factories, and other sorts of businesses. It is tragically not surprising that there is a tremendous need in Israel for these small businesses to get immediate assistance, and no organization in Israel has been more pivotal in providing this assistance than the Koret Israel Economic Development Fund, the KIEDF, which was originally established in 1994 and which has become increasingly pivotal, especially since October 7th.

We're delighted to host today three members of the organization, Adi Azaria, who is the CEO. Adi brings over eight years of experience in impact investing and financial management, with a long track record in leading, developing, and executing complex projects with cross-sectoral partnerships. Prior to joining KIEDF, Adi served as CFO of Tevet, which is part of the Joint Distribution Committee, the largest Jewish humanitarian organization in the world.

We're also joined by Chagit Rubenstein, Vice President of Operations and Director of Non-Banking. She is the Deputy CEO of the Koret Funds Association and manages the non-bank credit and microbusiness development programs of the association. For 20 years or so, she has been engaged in initiating, developing, and managing programs for the development of small and microbusinesses.

Adir Waldman is the Board Chair. He is the Managing Director of Freshfields Israel Focus Group, where he leads the international law firm's Israel-related businesses. He's been involved in a number of social and nonprofit organizations, including KIEDF, where he has served as chairman since 2021.

These three people are uniquely positioned to tell us about the unique challenges and needs facing Israel at this time, and to what is, to me, the incredibly important work of KIEDF in reaching out to Jews and Arabs businesses of different sorts, and providing micro and other kinds of loans at a time when it is critical to saving these businesses and to helping Israeli families get back on their feet. I'm delighted and grateful that they were able to join us for our conversation today.

So, we have with us, as I mentioned before, Adi Azaria, Chagit Rubenstein, and Adir Waldman. We've told you who they are, and of course, their bios are on the post itself, and all of them with critically important roles in the Koret Israel Economic Development Funds.

So, let's start, Adi, if you could tell us, first of all, thank you for joining, obviously. I know you're all ridiculously busy, given the times in which we're living and the work that you're doing, which is exactly why we're having this conversation. Adi, tell us a little bit about KIEDF, how it got started, what the original purpose was, and then maybe bring us up to October 6th, more or less. Then later on in our conversation, we can talk about after October 7th, how the needs changed in Israel and how KIEDF has responded to those changed needs.

AA: Great. First of all, Daniel, I wanted to thank you for hosting us here on your podcast. It's a great honor for us to discuss Koret and the activity that we are doing now within the field, especially since October 7th. But Koret exists for more than 30 years. We were established in 1994, and since then, we helped to facilitate credit to micro and small businesses within the geographic and social periphery of Israel. On top of the credit, what it's very important to understand, we also provide guidance and mentorship to those businesses, helping them to create growth and sustain profits and gain profits for their businesses in that matter.

Who are the clients? Who are the kinds of people that you're reaching out and helping?

AA: So basically, we help, and we assist for the most marginalized population within the geographic and social periphery of Israel. That means Arab, that means ultra-Orthodox, that means businesses that they are located within the geographic periphery of Israel, in the northern part and in the southern parts of Israel. We help businesses that their income is usually less than 5 million shekels per year, but most of our businesses are under 1 million shekels per year.

We are working a lot with female entrepreneurs from the Arab society through the microfinance program that Chagit would elaborate later and about the activity within the field because this is a very special and very innovative activity within the field, from all ends of society, basically. And what is very important to know also about Koret is the fact that we work through two main division.

The first division is the banking division, and it exists since 1994. And in this model, we have a very special model where we work in partnership with Bank Leumi, one of the biggest bank in Israel.

And through this partnership, the bank leverages 17 times more of our capital for loans which are distributed to customers that wouldn't get the loan from the bank itself without the Koret assistance. Basically Koret, subsidize the risk for the bank, and then the bank is able to provide loans to a client that he wouldn't have provided them to begin with because Koret is subsidizing his risk.

Are you assuming all of the risk, or is the bank also taking some risk?

AA: The bank takes 50% of the risk, and Koret assumes the additional 50%.

AW: The beautiful thing about it, Adi referred to it, but to be very clear, for every shekel we have on deposit of Bank Leumi meet, they can give 17 shekels of loan. And it's due to our underwriting capabilities that they're able to take that risk that they ordinarily wouldn't take.

Right. My listeners may not know, by the way, that getting loans in Israel is a very, very difficult proposition. I mean, forget small businesses, forget periphery, forget female entrepreneurs. The mortgage system here is very different than in the States. And just getting a business loan is a very different business enterprise altogether. It's much, much, much more challenging to get loans, even for people who are reasonably well-established. So that makes it all the more important.

AW: Exactly. It's a very It's a foreign point. Israeli banks do not take any risk. If you don't come to them with 100 plus % of the collateral for the amount that you're asking, you can't get a loan. Adi referred earlier to all kinds of peripheral borrowers, and we are helping lots and lots of people on the periphery. But even if you are, say, a Jewish business owner in Haifa and you want to expand your business, you probably can't get a loan unless you have a great credit history and plenty of collateral.

So, if I want to borrow $100,000 to redo my restaurant, I have to have $100,000 in the bank?

CR: Well, I think that over the years, the banks in Israel became even more strict than previously. Although we were hoping that the process will go the other way, they're very strict rules about who they give out to.

They're very risk averse is what we would call them, right?

Certainly. I don't think that always they will demand 100% a guarantee or security, but it's a big portion of the money. Usually, it's about at least a third. So, if you want to take $100,000, you will need at least a third or 50%, depends on your credit history, who you are, what business is, etc. There are a lot of into their risk analysis. They're putting a lot of issues that they check. But it's very difficult, and it's especially difficult for microbusinesses. Microbusinesses are the ones that Adi mentioned, which have less than a one-million-shekel turnover, even two-million-shekel turnover a year. They are not a target population that the banks are interested in.

For example, in 2022, Only 6% of all the credit that the banks in Israel gave to businesses was to businesses with a turnover of less than 2 million shekels, only 6%. While if you look at how many people applied, most of the applicants were from microbusinesses. The connection is not that they didn't apply, just that the banks doesn't like giving them loans. It's been like this for years, and it has increased. The trend is worse following the war.

We'll come back to the war in a second. Now, on a typical year, how many loans are you making to small businesses and what percentage of the applicants does that represent?

CR: Well, last year, we've given about 30 million shekels of credit with non-bank loans, and it is about 30% of the applications.

Okay. When people apply, they're judged on the basis of how peripheral they are, what the likelihood is of they're being able to pay it back, the business plan, all of those things?

CR: Well, first of all, we want to make sure that they can't get a loan from a bank because if they can, they should go there. Then if they have a 5-million-shekel turnover, then we will say, sorry, we are not the place to go to. All kind of criteria that we have to check, and we make sure that they are not currently prohibited by the Bank of Israel to get credit because there is that issue too, the people that got paneled by the Bank of Israel, and they can't get credit from anyone. We're checking all these things from both extremes. We make sure that there's an existing business, something that's really happening, and that the person who runs the business knows what they're doing because that's very important. And then we, of course, make our analysis if we think that they will pay back because in the end, it's a loan. It's not a grant, it's not a gift. So, we do the analysis for that.

AW: Daniel, there's a great book that many of your listeners will enjoy by Muhammad Yunus called “Banker to the Poor”. And when I first became chair, I came to Chagit and I asked her, how do I learn more about what it is that we're doing? She said, read this book, “Banker to the Poor”. And when you read it, you understand really the need that small entrepreneurs have for credit and how people, when they're given some credit, can really follow through and build a business and a life for themselves in a way that they can't otherwise. And what Chagit has done, together now with Adi, is to really import the system that Muhammad Yunus built in Bangladesh, here to Israel. And you see exactly the same phenomenon that he talks about there, here.

Wow, that's unbelievable. I want to check out that book. What percentage of the... well, first of all, you said you gave out 30 million shekels in non-bank loans last year. So that's money that you have to actually raise to distribute. Is that correct?

AA: Correct.

So, part of your collective work at running this organization, whether it's Adir or as the board or Adi or Chagit, who funds this? Where does the money come from? Bank Leumu is Bank Leumi for the bank loans, but for the non-bank loans, how does the KIEDF get the money that it's using to support small businesses in Israel? Again, before October 7th. We'll come back for October 7th, later.

AA: First, we discussed the banking division earlier. But like Chagit and Adair mentioned, there is another division, the non-banking division, which provides direct loans, and it has different kinds of funds. Okay? And Chagit will elaborate on that later. But regarding your question, what you asked regarding the fundraising, the non-banking division works in a blended finance manner. If you are familiar with this term, and if not, we can maybe mention a little bit what it means to your audience.

Yeah, explain it. You should definitely explain it.

AA: Perfect. Okay. So, when you work within a blended finance model, you have certain layers of capital. Each layer of capital is supposed to address different needs and different kinds of risk in matters in the fund and in the product itself. I will explain what it means. When you look at a loan fund, the first layer of capital is the enabler. And usually, it comes from philanthropic capital, and it comes from the government. That layer of capital is able to absorb the most riskier part of the fund. That means that if you have some default, the first layer absorbs it, usually. You can create a different model, but if we will facilitate it and make it more easy, that's what it means.

The second layer, and it could differentiate between different investors, but it's the layers that provide an investment with an interest rate that usually is below market rate in that matter, with a low interest rate. Usually, a lot of impact investors and a lot of capital is raised in that matter. This layer is the layer that leverage the capital. If usually you raise this philanthropic capital and you have, let's say, 10 millions of dollars in philanthropic capital, then you are only able to distribute or to deploy 10 millions of dollars in capital.

But if you raise this layer in philanthropic capital and then you leverage it by an impact investor layer, then you are able to do 10 times more. That means with the $10 million raise from capital, from philanthropic capital, you are then able to deploy 100 million. We are able to, today, to leverage it by 10 times in the non-banking loan division. And this is an important part because that way you can create a deeper and on a larger scale of an impact.

Now, I just want to ask, so theoretically, if a philanthropic, not talking about one of the investors, but just a philanthropic entity, whether it's an individual or foundation, makes, let's just say, hypothetically, a million-shekel contribution. They're actually making available to you 10 million shekels in funding because of the way they were able to leverage it. Is that correct?

AA: That is correct.

That's a pretty extraordinary philanthropic model. I mean, there's a lot of bang for the philanthropic buck in that.

AW: Exactly. So, I wanted to make three quick points about your comment, Daniel, your question about our need for capital. And I wanted to say as follows. Number one, unlike organizations who say take care of Holocaust survivors or feed the poor, our only currency is capital. And so, yes, in order to do more good, we are in need of more capital. And that is part of the reason why we brought a deal on recently to try to reinvigorate ourselves and raise fresh capital.

Number two, I'm very proud to say that we're starting now to make strides raising capital from Israel. Historically, almost 100 % of our capital has been from American Jewry, starting with Koret and then other mostly American Jewish foundations. We recently, for example, received an investment from a group of Israeli tech entrepreneurs who have their own family office philanthropic foundation called NextGen, and they're supporting what we're doing in response to the war. So that, to me, is extremely exciting news.

And the last thing I'll say is, when you put together the leverage that you just talked about and the fact that we have very, very low loan losses, historically under 5%, maybe actually under 2%, depending on which program you look at, this money is sustainable over time. So, the 10 million shekels of loans that we can give today, based on the 1-million-shekel donation that you just talked about, 30 years from now, it's going to be doing 20 million shekels of loans, or 50 years from now. It will continue to be recycled and to help more and more people.

Wow. Okay. Now, I would love to ask more questions about this because I find it fascinating, but I want to make sure that we talk about October 7th and the aftermath. It's obvious to all of us but let me just make it sure it's clear to our listeners, there are entire swaths of the State of Israel that are essentially uninhabitable right now. People have started to go back to the otef, to the Gaza envelope. In some communities, it's up to 70%. In some kibbutzim it's much, much, much, much less. But there's been huge destruction. But people are beginning a little bit to move back.

But what we have in the north is an increasing disaster. In other words, before we actually got on, all of us, and I was just speaking to Chagit, who is located in Haifa, she was saying in a certain way, and it's true, tragically, if you look at the map, it's an outrageous thing to say, but that Haifa has become the northern border, in a sense, because north of Haifa, it's very hard to live. It's very hard to keep your family. It's very dangerous. There are rockets, there's fires, there's all sorts of invading aircraft, how do you say that? Like armed drones and all that thing.

And that means that an enormous number of businesses, both from the south and from the north, have either had to relocate or shut down or try to work against all odds to try to make a go of it. So maybe one of you could start out by just telling us economically, after October 7th, but more especially as things got deeper and deeper, what's happened to the Israeli economy? What's happened to small Israeli businesses? Who are the populations that are most affected by this and so forth?

CR: First of all, you should know there are about 620,000 small businesses in Israel. Of them, close to 90,000 are what we call microbusinesses with a turnover up to two million shekels. So, the majority of the businesses in Israel are not Strauss and the big banks. It's a small business, a little café, a carpenter, somebody who fixes cars, et cetera. 25% are in the north and south, in what we call the northern region, and the southern part

So, 25% of the microbusinesses.

CR: Right. So, all of them were impacted for sure. All those in the south, and of course, the ones in the north, are still Israel, hardly were operating. Now, the thing is there are many small businesses or microbusinesses in Israel, across the country. In Tel Aviv, Jerusalem, Hadera, Beit She'an, wherever, Ramat HaGolan, for example, near the Kineret, that have been impacted a lot by the war, even though they are not on the border. For example, a lot of businesses connected with tourism, food, like restaurants, a lot of restaurants didn't open again after because the people don't feel like going out, except Tel Aviv. Put that aside. Tel Aviv is a different country. But in most of the country, we see a big decline in all these businesses that connected to entertainment, culture, shows, even all things like this. That's a big portion that is still hurt. There's a big problem with agriculture, although it is starting to come back, but what we saw after the war, following the war, that the agriculture was based, most of the employees were foreign workers, at least a big portion of them, and a big portion of them just fled the country after the war…

Understandably we should say, by the way.

CR: Yeah, I understand them completely. Now they're starting to come back, but we're talking now eight months after, seven, eight months after. Even if you are not in one of the risk areas, meaning, let's say you have a business farm near Haredi, which is in the middle of the country, still, you had no employees. So, a lot of the farms really suffered a big decline in the output. Of course, we can see it in the markets, the prices of fruit and vegetables, et cetera. Now, the farmers in the north are even in a worse situation. They had no one to pick the fields, and then fires that are now happening following the missiles and the heat because of June, July, et cetera. A lot of the fields are just burnt, filled with all different things they grow in.

Yeah, just for people to understand, we're talking about thousands and thousands of Dunams, which is also thousands and thousands of acres. I mean, a huge part of the north has been burned. People don't really understand that, I think, outside of the country. But when you go into the Israeli news and you look at the maps of what's been consumed by fire in the north, it's just heartbreaking because in addition to the fact that it was a gorgeous part of the country and is now going to have to be completely replanted and it's going to take forever for it to become green again, there's an enormous number of businesses and agricultural enterprises that were destroyed. Am I getting it right?

CR: Completely. So, overall, what we saw following that is that although the need is for us, we were approached by types of businesses that until October never talked to us because they went to the bank and got a loan.

Give us some examples of the kinds of businesses that formerly would gone to the bank and now need to put you.

CR: All the farmers that we talked about, the farmers that we talked about, many of them have 4, 5-million-shekel turnover. But when you are not, you don't have any income in October, November, December, let's say three months, if they were lucky to come back to their field in January, those who were in the south, some, most of them came back in March. So, suddenly you have a terrible no decline in your income, and then you still have all the debts to pay, all the products that you bought up to a day before the 7th of October that you still have to pay them. A lot of them, the banks didn't changed the criteria. They even made it more strict because, again, they're a bank. They look at a business that didn't have any income for three months, and they say, hey, he'll never pay back. Why should we give him? So, we were approached with a lot of businesses that were never in need of a special aid in credit. I would say that. Farmers is just an example, but a lot of them, we're talking about thousands, thousands of money.

AW: I was just going to say, while we're talking about farmers, we were approached very soon after the 7th of October by Leket Israel. I'm sure a lot of your… it is an amazing organization. They came to us, and they said, listen, our farmers have a real problem. They need help. And we have capital, but we don't know how to get capital to our farmers. Can we work together? And so, we started an amazing program together with Leket. They've been helping us fundraise. They've been sending farmers our way. And we've been issuing loans to farmers that they introduced to us. And we have now actually, unfortunately, since October 7th, the chairman of Leket lost his son-in-law in the fighting in Gaza. And he and many other friends of his son-in-law, David Schwartz, zichrono livracha, have established a fund in his memory. And what we've done is all of our efforts within our broader emergency fund, which we are doing in response to the war, the efforts vis-a-vis farmers we've named in memory of David. May he rest in peace, zichrono livracha

Let me ask you a question. I mean, obviously, I live in Jerusalem. I can tell you about all sorts of small businesses. I mean, our gardener, for example. Our gardener is a lovely guy who used mostly Arab gardeners. He would come himself and bring a couple of Arab guys with him. Perfectly lovely people, but they don't come in anymore because they can't get in. Security has been tightened. We had a plumber guy who was doing some work, who we've used over the years, always came with a couple of Arab guys, lovely guy. They're not around. There are all kinds of business. It doesn't have to be an agricultural business. You can be dependent on Arab workers in Jerusalem or Thai workers from other places. I don't know if you know the number here, but if anybody does, you do. What number of Israelis have the food on their table impacted by the number of businesses that are struggling? In other words, if there's a farm, that's not just the farm that's struggling. That's people, when they sit down to dinner, it's very tough. Do we have any sense of how many Israelis are filling economic pressure or deprivation because of what's happened in the war? I have no idea what that number is, but maybe you do.

CR: Well, I can tell you what the government published at the end of in January, which is not updated, but they waited for the first three months of the war. It was 50% of the small businesses felt a decline of more than 50%. We're talking about 550,000 families, 50% of them felt a decline, a major decline in their income. But it's more complicated than that because what happened is that the government, following the reality, for the first few months, gave oxygen injections to these families by giving very small amount of money as compensation, but just to make sure that they're not hungry, which is nice. So, nobody died of hunger yet in Israel because of that. But what happened is that these compensations stopped in the south completely. In the north, they continue for those who are in an officially regions that the government said that you can still ask for compensation. But these compensations don't help the business. They just make sure that the families have something to eat. The businesses don't have any help. They don't. And they are in a situation where that now, I believe that now we will start hearing about closures and bankruptcies because that little oxygen that was given to them in January, February is gone, and the reality is still here.

AA: I wanted to mention, Daniel, that it's very important to understand what Chagit just talked about and what Adir just mentioned. We're talking about businesses that usually they were fine. They went to the bank, they got what they need, they had food on their tables. But basically, we talk now with those businesses, and now they are labeled as risky businesses. They are businesses that struggle every day to put food on their table. The statistic talks about 77% of the small businesses within the northern and southern part of Israel that lost more than 50% of their income. When you talk about the southern part, some of them came back to work and they are now processing their fields, if we're talking about farmers, and some of them came back to their homes. But a lot of the people within the north because this difficult situation, haven't gotten to their homes yet.

So, these businesses weren't the usual suspect to be a client of the Koret Israel Economic Development Funds. But today, we find them as our clients, and we find it as our duty to help them in this current situation that they're in. And that's why we launched this new fund during January, after October 7th, because we understood that after the primary needs, the humanitarian needs, the food on the table, the house, a bed to go to sleep in would be answered, then Koret would need to help in order to create rehabilitation for these households. Most of the businesses, they provide for their homes, they are households, and they need us in order to get that support.

What's this new fund called?

AA: An emergency loan fund.

What's the rate of increase that you've seen in people turning to you, let's say, November 2023 versus November 2022?

CR: Well, the thing is, it's a completely different picture because, as I said, we have now about 600 new applicants that would have never reached us because they had their own sources of credit from the bank, et cetera, the regular way. This is just since January. We started the fund only in January. So officially, we are writing down the numbers as of January. We believe the need is 10 times more, at least. It's just that there's a capacity in how people know about us, and it takes time, and people think, oh, it will be okay. The government will help. All these things, they have their wishes and dreams. Nobody wants to take a loan if they don't have to because you have to pay it back. It's not nice.

Right, there's an unfortunate theme here, right? I mean, tragically, I mean, horrifyingly, there were people stuck in Be’eri and Kfar Aza on October 7th who said, the army is going to be here any minute. Then the people who had to leave the kibbutzim felt, oh, somebody's going to... well, obviously, the government's going to help us find a place to stay, but it took a very long time. There's been a tremendous amount in Israel that has been Hamalim, civilian command centers, and all sorts of bottom up, not top down. And in a way, you have the expertise of top down, but the social orientation, more or less, of bottom up.

I want to ask you, because our time is running a little short, I want to ask you about one other profile that I always think about. I mean, in our community here in Jerusalem, people are in and out of miluim, reserve duty in Gaza all the time. And I'm not talking about the 22-year-olds who just got out of the army who go back in. I'm talking about fathers and mothers of families with four and five kids who also run small businesses. And people go into Gaza for three months and then come out. They come out for a Shabbat here or there. But in terms of working, they're gone for 120 days, they're gone for 160 days. Some people have been gone for longer than that. Are you guys dealing with that profile of people also? In other words, the business hasn't been hit by fire or whatever, but the people were drafted. What's happening there?

CR: In our fund, we have special terms with very, very low interest loans, up to 100,000 shekels. To businesses in the northern border, in the southern border, and people who were in miluim, in their reserves. They are included in the special terms. They just have to show that they've been in miluim in their reserve more than 30 days, and then they get the special conditions. Also, a very important part is that they get six months grace, meaning that, let's say, they get the loan today, they will start paying it only in January. And hopefully by then, we'll all be happy and smiling. But if not, will we reconsider and may even extend that time to make sure that we don't charge them, they don't have to pay back if their business doesn't come back to operate.

One thing I wanted to say about what you mentioned, your gardener in Jerusalem, is that a very big part of the businesses that have been hurt are connected to the building constructions. A lot of small businesses help their building constructions. The carpenter, the people who made the aluminum, the plumber, et cetera, et cetera. And when there's no new construction because there are no workers, they all suffer. So, the whole industry is on hold, and it hasn't changed much.

Yeah. I wanted to ask you one other question about this. If a person comes back from three, four months in Gaza, let's say, and they've been a perfectly capable business owner. They learned it from the ground up, and they do a good job, and they're not huge risk-takers. There's a different skill set in rebuilding a business that's been hit by a catastrophe, whether it's a fire or the loss of equipment from an explosion or just the main business owner being fighting at war for three or four months. That's a different a skill set of recreating what you had than doing what you were doing before. I know that when you start out with your microloans and other loans and people are just starting out, whether it's women, let's say, from the Bedouin community or the Arab community, part of what you do is offer them expertise to make sure that their chances of success are greater. Are you able to offer advice, consultation, partnership in that way with, let's say, men and women who just they were in Gaza for three months. They know how to run their business, but they do not know how to rebuild their business. Is there a need for expertise and are they able to get it?

CR: First of all, I want to make one thing clear, if a business was hit by a missile, we are not the answer for them. The government has had for those businesses, they do have special services, special funds, et cetera. But those are the ones that were physically impacted. But most of the businesses were hurt, the income was hurt, but not the structure of the business or the store or et cetera.

Yes, we are developing now a whole division that is supposed to, we give help on the first emergency needs, but now we want to help them moving on, recreating their business. But from my experience of many years in the field, most of these business owners are very, they know what they need. They know how to rebuild their business, and they need some extra help. It's not like they're going to stand in line for trainings of a month. But yes, we are certainly going to offer that, too.

AA: I just wanted to add to what Chagit just mentioned. We do see this need within the field from our staff within the field. And as Chagit mentioned, they know what they need, they know what they need to do, but sometimes they need our guidance and our aid in order to get there. And we are certainly now are working on raising some capital and developing the special program that would help them to reach that place where they know what they need. So, we are certainly aware of that, and we are hoping to have that answer to this situation soon.

Great. Well, our listeners who are interested can see on the written part of the post all the links that we're going to have to the KIEDF and the various projects that you have and learn more about it, which I hope you will take a look at very carefully.

I have just to say, for all of us, we're all in different cities. Two of you are in Tel Aviv, one of you is in Haifa, I'm in Jerusalem. But no matter what slice of life we're from, and almost no matter what generation and our backgrounds, this is just a period of unbelievable raw pain for all of us. We're worried about the future. We're heartbroken for the losses that have taken place. It's just an agonizing, agonizing, agonizing time. And I have to say for all of us, I'm sure you feel the same way, that what gives us hope about the future is the people of Israel. Some people have this view politically or that view politically. Some people think this about the army, that about the army. The individual soldiers, I think we all have boundless admiration for their courage and their devotion. Higher echelons is a different story. But what gives us inspiration and a belief that this place is going to see this through is the extraordinary, you know we say in mincha on Shabbat, we say, “Who is like this nation, Israel, this a singular nation in the world”. You can believe or not believe, you can pray or not pray, but that line, that there's something unique about this people, I think we're all seeing it to be true in a certain way. We're just seeing something unbelievably powerful, dedicated motivated, proud, caring, emerge out of this population that we always knew was there, but we're seeing it now really with huge spotlights on it.

The work that all of you do at KIEDF, in normal times, to help people from the periphery, the geographic periphery, and the economic periphery, get their starts and hopefully build this economy and build their lives. But especially now, after October 7th, it's just really unbelievably inspiring to me to hear people like you doing the work that you do. It's really avodat kodesh. I mean, it's really sacred work. And I have no doubt that the people who are listening to us are also feeling the same thing.

So, I just want to end by thanking you, thanking you for what you do, but also by thanking you for in the midst of these crazy days that you're all facing for taking the time out of the middle of the day to come and tell the wider world about the work that you're doing, about the needs that there are. I hope that people will respond in all sorts of ways by learning more about you and getting in touch with you, and that the next time we get together to have a conversation, we'll talk about the difficult period that's now behind us, and we'll find out how KIEDF has morphed once again to help develop and train and aid an Israel that is postwar and booming once again with all sorts of new opportunities and new needs. But for all that you've done until now and for all that you've done since October 7th, and for your time today, my deepest, deepest thanks.

AW: Thank you so much.

AA: Thank you.

CR: Thank you.

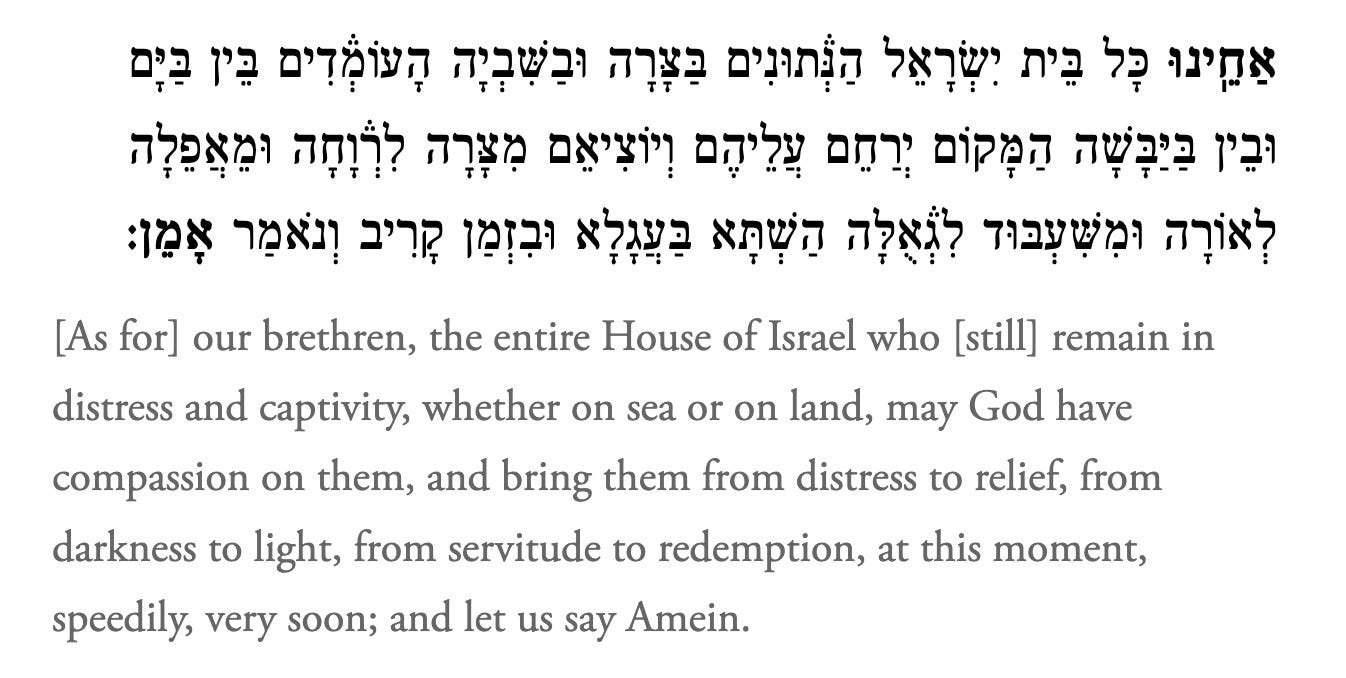

Music credits: Medieval poem by Rabbi Shlomo Ibn Gvirol. Melody and performance by Shaked Jehuda and Eyal Gesundheit. Production by Eyal Gesundheit. To view a video of their performance, see this YouTube:

There's a home-front, too, and small Israeli businesses are getting some much needed help